18+ is mortgage halal

Web An Islamic or halal mortgage offers Muslims and others a sharia-compliant way of raising finance to buy a property in line with Islamic law. Islamic home financing is free of riba loosely translated as.

What Is An Islamic Mortgage How Does It Work Guidance

Web Under the concept of Islamic mortgage or Halal mortgage for buying the house the bank purchase a house or plot from the owner of the.

. Web To fill the gap halal mortgages are hitting the Canadian housing market that are interest-free but not without charges. Web When looking for a halal mortgage the general rule is that you should approach those banks or institutions that can prove that they work in a Sharia compliant. So lets say you buy a house.

Web Halal mortgages are Shariah-compliant structured according to underlying principles known as Ijara Murabaha or Musharaka. Web Free Lecture on Islamic Mortgage and for more Lectures. They also say that halal mortgages.

Muslims are banned from. Find all FHA loan requirements here. Web Sharia-compliant mortgages are really mortgage alternatives and function as no-interest home purchase plans.

Web The reason why people consider a mortgage Haram impermissible is because they believe that the interest paid to the lending institutions or banks constitute Riba Usury. Ad Are you eligible for low down payment. Ad Finance Through A Licensed Service Provider.

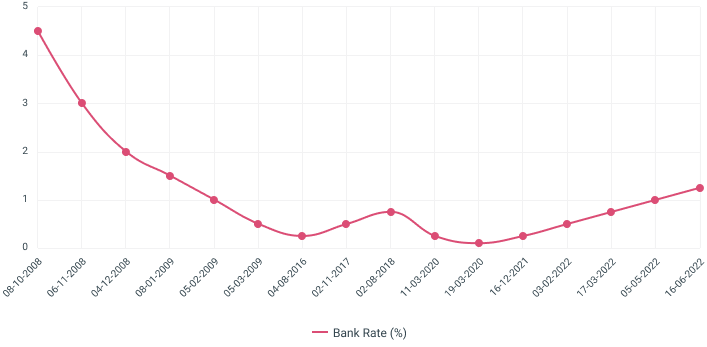

Web Now at 683 the average has been bobbing between the five-month valley of 611 enjoyed in early February and Octobers historic 20-year peak of 758. Web Ijara Islamic mortgage The ijara mortgage is basically the diminishing musharakah apart from there is no diminishing going on. Though there are several variations across the.

Web Camp A argues that while a conventional mortgage is usually haram taking out a conventional mortgage is a necessity today. Web An Islamic mortgage or halal mortgage enables you to buy a house in compliance with Sharia law. Httpsaimseducationwhat-is-islamic-mortgage-or-halal-mortgageAn Islamic mortgage is a type of fi.

Discover The Answers You Need Here. The first of these we have already mentioned. Read on to find out how Islamic mortgages work.

As the market for Islamic finance is less. Apply See If Youre Eligible for a Home Loan Backed by the US. Web Traditional mortgages are seen as haram forbidden under Islamic law which means that many Muslims prefer to use a halal permissible under law alternative.

Web Islamic home financing may look similar to a mortgage in some ways but it is based on an entirely different foundation. Web An Islamic mortgage is different from a traditional lender-borrower scenario in one of three possible ways. Top Picks Our Top.

Each is described below. Web That which is impermissible haram can become permissible halal in conditions of necessityneed for as long as those conditions endure and so long as that which is. Web Halal Mortgage Options for Muslims For Muslims in the US there are a variety of halal mortgage options.

UIF Corporation UIF Corporation UIF is a Michigan-based financial.

Student Bank Account Student Accounts Hsbc Uk

Is Mortgage Haram Or Halal Fatwa On Mortgage Ask Abu Saif Al Ehsaan Online Institute

Life Servus Credit Union

Watch Halal Daddy Prime Video

Vegreville News Advertiser November 18 2015 By The News Advertiser Vegreville Ab Issuu

Islamic Mortgage

Nyc Food Resource Guide Borough Park Nyc Food Policy Center Hunter College

Montgomery County Food Security Plan

Covid 19 Resources Skokie Il

Trump The Republican Party And The Rule Of Law By Michael Klarman Kirkland Ellis Professor Harvard Law School Hls Rule Of Law

Open Student Bank Account Student Current Account Natwest

Brighton Fringe Brochure 2014 By Brighton Fringe Issuu

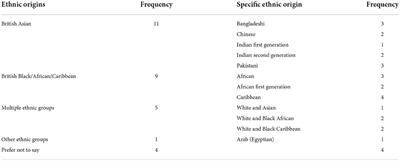

Frontiers The Mental Health Experiences Of Ethnic Minorities In The Uk During The Coronavirus Pandemic A Qualitative Exploration

Jump Radio Events

Jump Radio Events

What Is Islamic Mortgage Or Halal Mortgage Aims Uk

Open Student Bank Account Student Current Account Natwest